Almost all economic and financial activities in USA involve taxation. Taxes often constitute significant costs in conducting ones’ business operations, in investing ones’ wealth, and even in maintaining ones’ standard of livings. Therefore, tax planning forms the core of an individual’s overall financial plan.

Investors / taxpayers often find themselves perplexed by the potential tax consequence of their important financial decisions when they get piecemeal financial advices / opinions from different people who may not have a good understanding of the intricate relationship between taxation and other personal finance areas.

In today’s challenging economic environment, in order to enjoy a comfortable financial life, one needs to formulate and execute a coherent strategy to effectively and profitably manage one’s personal finances: taxation, insurance, financial assets investment, real estate holdings, retirement planning, college funding and so on,…..

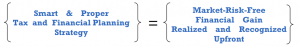

Therefore, I incorporate my financial planning expertise and my quantitative skills in my core services of tax return preparation to help clients better coordinate their personal finances and increase their after-tax income and grow their wealth, based on the following belief:

Furthermore, Terry Y. Luk and his network of business associates offer the brain power of a professional team to help clients. In addition to my actuarial mathematical quantitative ability, my broad knowledge in personal finances, and my 22+ years of work experiences in the insurance, investment, banking and taxation industries, clients can also benefit from the expertise of a professional team of associates, such as, attorneys, accountants, personal bankers and real estate professionals.